Lender Insights

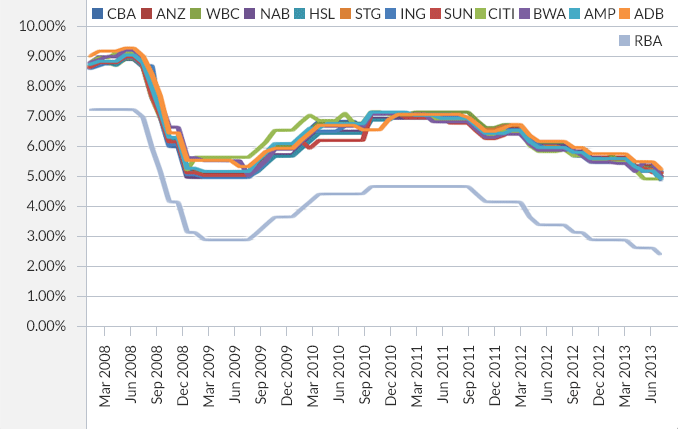

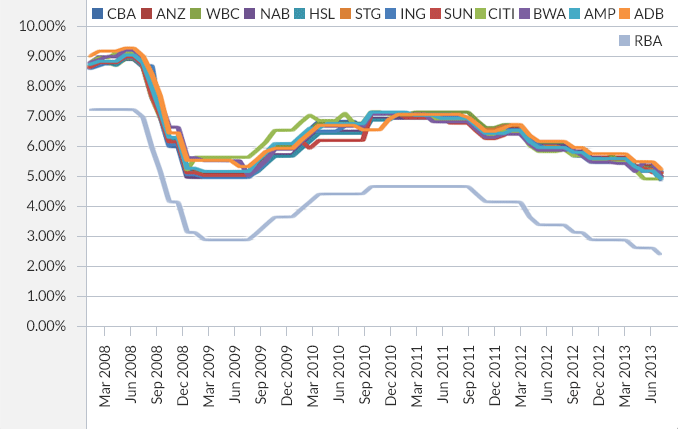

Rate Movements Over Time

- BWA had greatest High-Low variance: 9.18% → 4.99% (4.19% spread)

- ANZ had smallest High-Low variance: 8.88% → 5.04 (3.84% spread), suggesting more predictable pricing

- This compares to RBA High-Low of 7.25% → 2.50% (4.75% spread), suggesting

- — Lender movements more confined than RBA and

- — Banks reluctance to follow confined than RBA and RBA downwards during rate decreases

- 5.04% was the lowest rate over entire period, offered in Feb 2009 by CBA – Sep 2009 by NAB

- 9.25% was the highest rate, recorded by ADB in Jul – Aug 2008

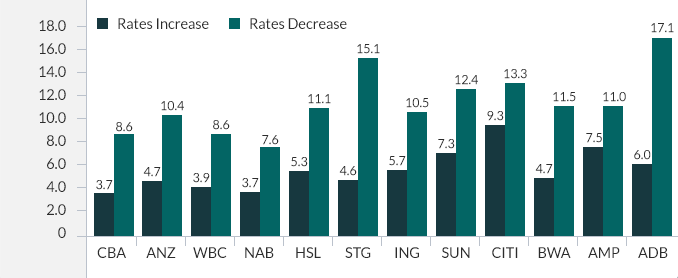

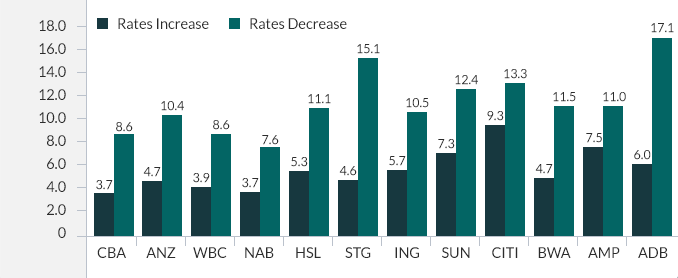

Days to respond to RBA rate increase or decrease

- On average, lenders are more than twice as quick to pass on a rate increase than they are to pass on a rate decrease

- Again this analysis only counts move where lenders move in the same month as an RBA rate change.

- Thus, the days response to a rate increase or decrease is likely to be understated for months where lenders "wait and see" before they change rates in subsequent months.

- Nonetheless, the general behavior is still shown

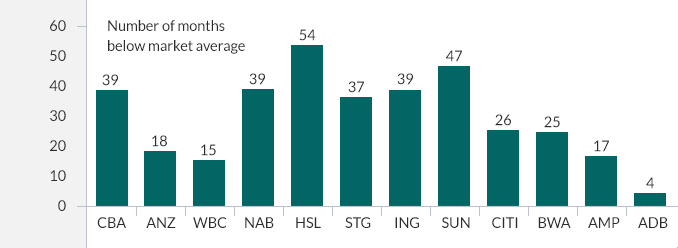

Propensity for below average

- HSL showed the highest propensity to stay below the market average with 54/ 66 months (82%) below average

- SUN was the second best performer, with 47 / 66 months (71%) below average

- Out of the majors, CBA and NAB had 39 / 66 (59%) months below average

- ADB had only 4 / 66 months (6%) below market average, making it the worst performer

- WBC was the second worst performer with 15 / 66 months (30%) below average

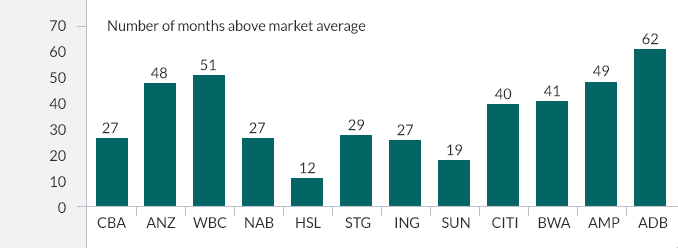

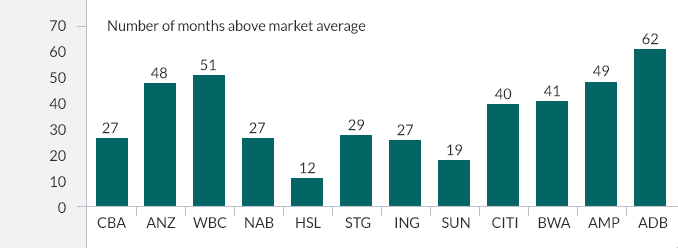

Propensity for above average

- ADB showed the highest propensity to stay above the market average with 62 / 66 months

(94%) above average - WBC was the second worse performer with 51 / 66 months, followed by AMP (49 / 66)

and ANZ (48 / 66) - HSL were the least likely to be above average with 12 / 66 months (18%); SUN was second

with 19 / 66 months (29%) - CBA, NAB and ING were third to be least likely above average with 27 / 66 months each (31%)

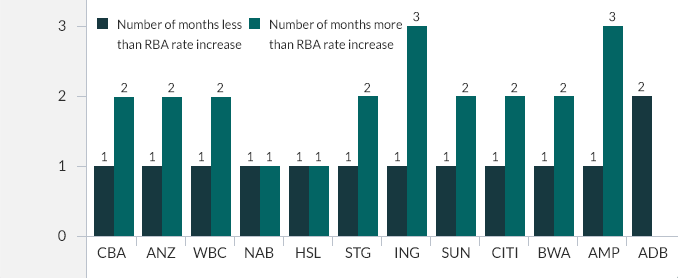

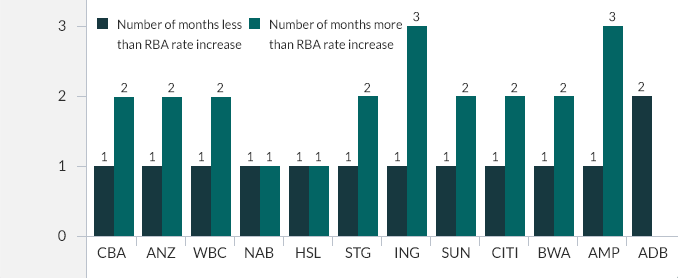

Response to RBA rate increase

- Lenders were more inclined to increase rates by more than the RBA during a rate rise

- All lenders increased rates by more than the RBA at least 1 / 7 rate increases (NAB, HSL), but more likely 2 / 7 (CBA, ANZ, WBC, STG, SUN, CITI, BWA), and some 3/ 7 (ING, AMP)

- Note: this analysis only tracks movements within the same month as a RBA. Lenders may increase rates in subsequent periods, without any change in RBA rates

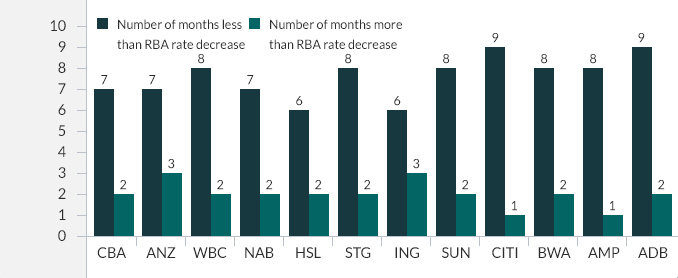

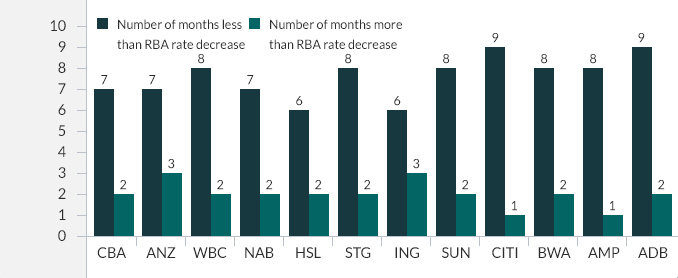

Response to RBA rate decrease

Over the period of March 2008 to Feb 2013, the RBA decreased the cash rate 12 times. During this time:

- In general, lenders were less likely to pass on a full rate cut and / or would leave rates unchanged while the RBA decreased rates – this would be for at least 6 / 14 rate decreases, with as many as 9 / 14 (ADB)

- While all lenders were decreased rates by more than the RBA at least 1 / 12 rate decreases, this was more likely to be "catch up" from a prior rate decrease by the RBA which was not followed than a genuine decision to be more generous than the RBA

- Again, this analysis only tracks movements within the same month as a RBA

These insights were compiled using the "Standard Variable Professional Pack Rate" of a $300,000 loan at 70% LVR, lenders included in this analysis are Commonwealth Bank of Australia, National Australia Bank, Westpac, ANZ, Homeside, and St George Bank. Data: Finware. This loan scenario may not be reflective of individual circumstances, and the period of analysis between March 2008 and February 2013 included periods of varied economic conditions. Past performance is not necessarily indicative of future performance. Disclaimer.